All businesses get various types of claims: customer service, delivery, vendor payment. These categories also include internal claims like employee’s requests for benefit, business mileage or workers compensation. Proper claims management requires input and contributions of numerous employees and departments. It is vital for business to ensure a smooth claims process to build strong relationships with clients, partners and team members.

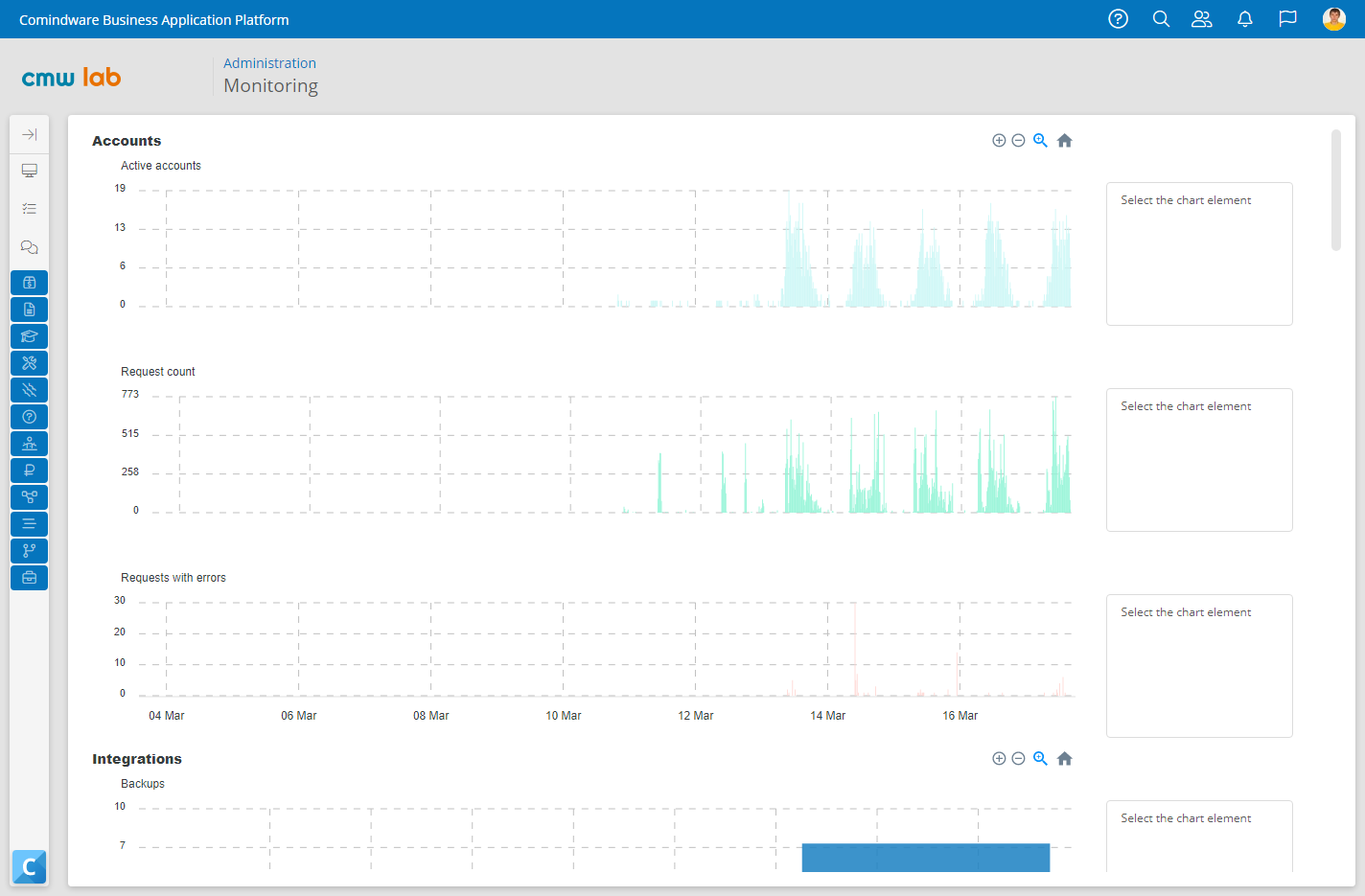

Low-code claim management company software by CMW Lab enables businesses to automate claims processing with ease. Design, run and modify claim settlement processes that are highly intelligent, agile, and ready to deliver ROI. Claims processing system empowers non-technical users to create their own workflows, optimize and reconfigure claims process on-the-fly to meet changing circumstances.

In the world of digital communication, consumers expect their requests being handled in the most timely, personalized and accurate manner. Focus on creating the exceptional customer experience and customers’ retention, speeding up the claims processing.

Optimize the number of human touchpoints in the claims management process. Effectively spread the workload letting your team concentrate on business-critical tasks. Streamline the process and eliminate unnecessary steps, decreasing the costs of resources needed.

Effective claims management can help insurers comply with regulatory requirements, such as reporting and disclosure obligations, avoiding fines and penalties. Provide policyholders and claimants with clear and concise information about their rights, obligations, and the claims resolution mechanisms.

The Best Business Process Management Software in 2023

CMW Platform is rated #1 BPM suite in 2023 to start your business automation.

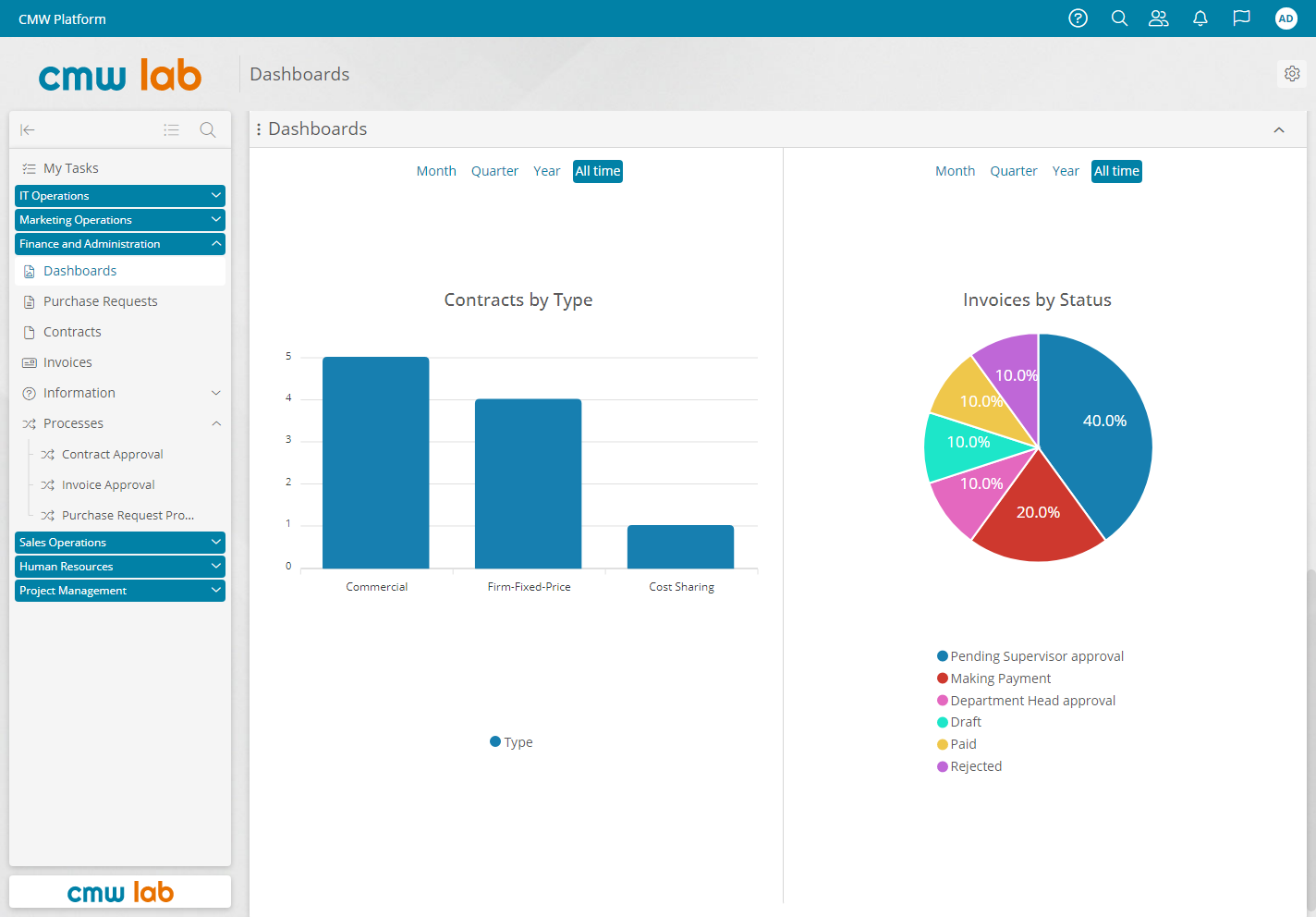

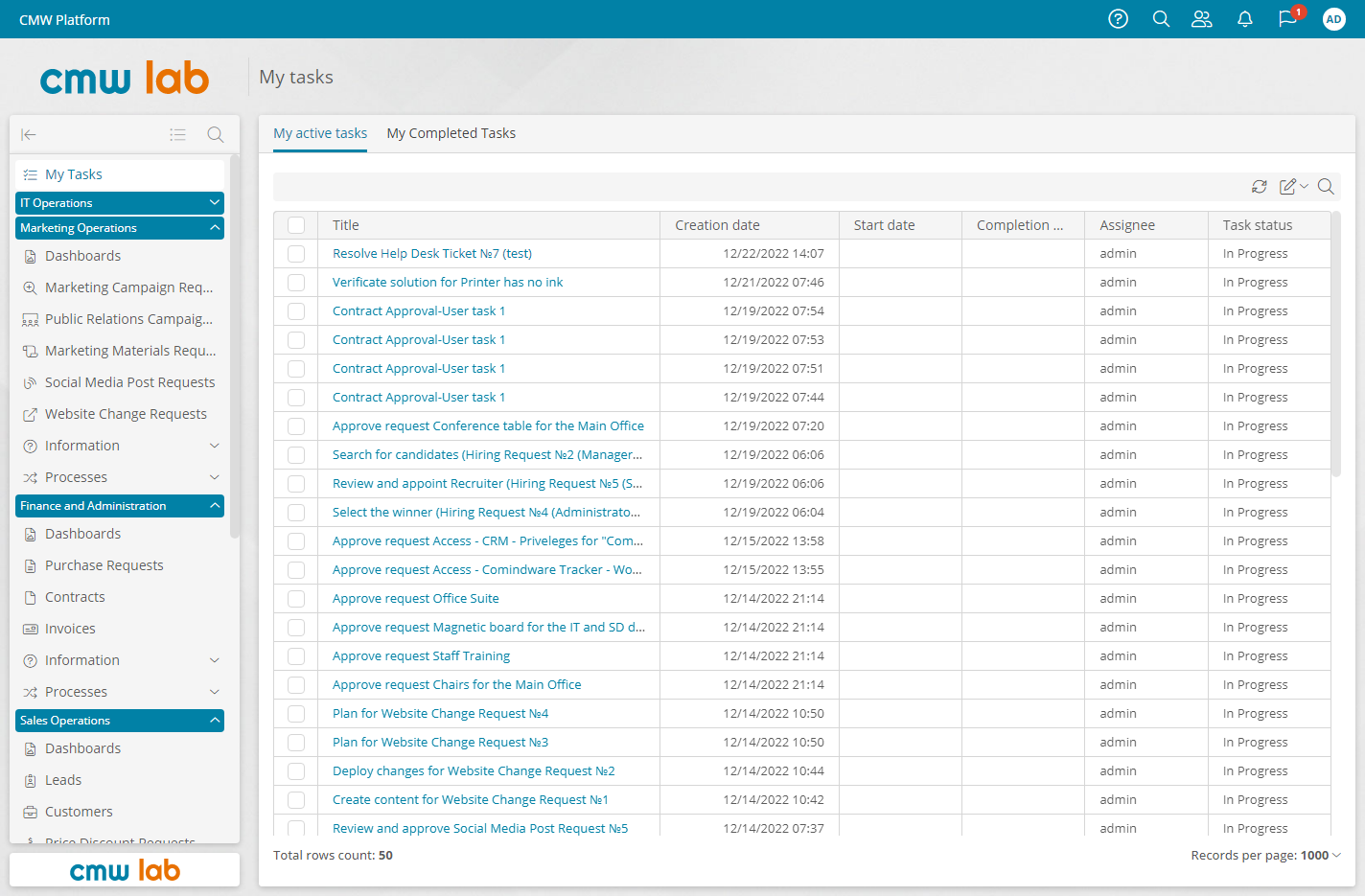

Get end-to-end claims workflows that are customer-focused, cost-effective, and adaptable automated and running within days, not months.

Enjoy advantage of on-the-fly changes to claim forms and automated claims management workflows and claims processing software flexibility.

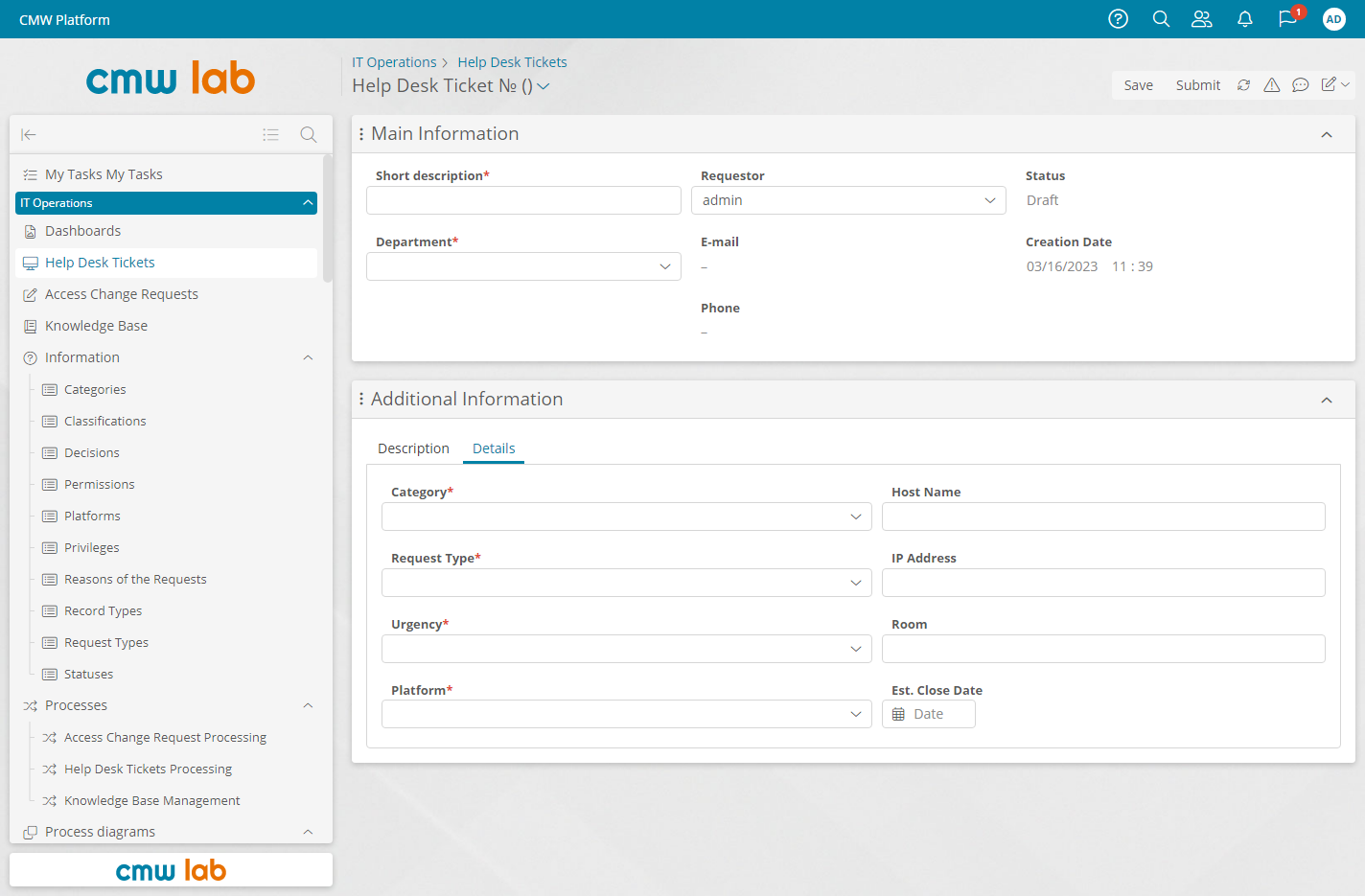

Configure different claim forms for various claim processing scenarios in a web-based claims management system software.

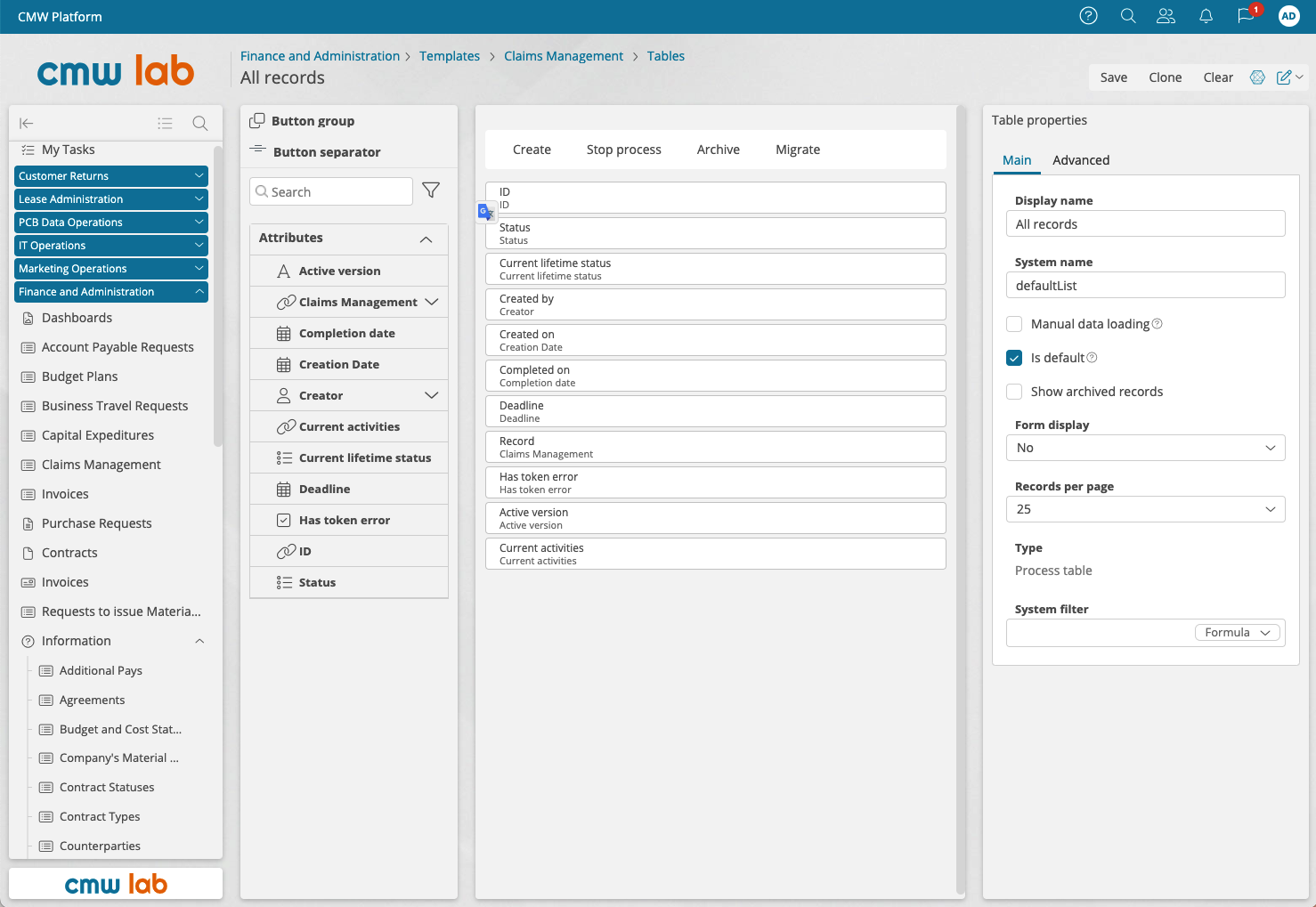

The automated claims processing ensures that all claims data – such as associated policies, claims history and similar cases are immediately available to enable claims settlement.

Automatically process claims from start to finish, using pre-determined business rules and automated decision-making system. The entire claims process, from submission to settlement, is completed with minimum human intervention.

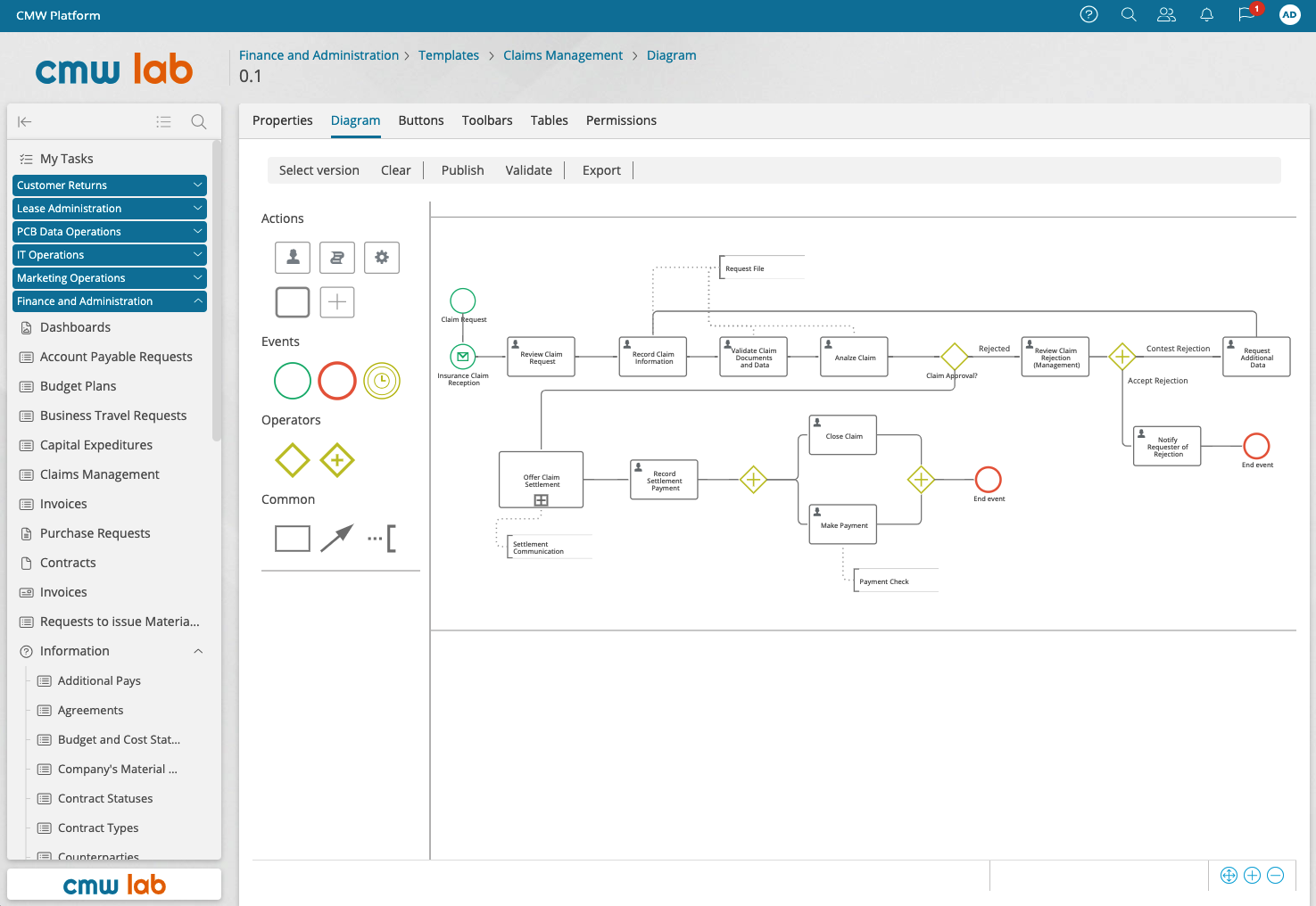

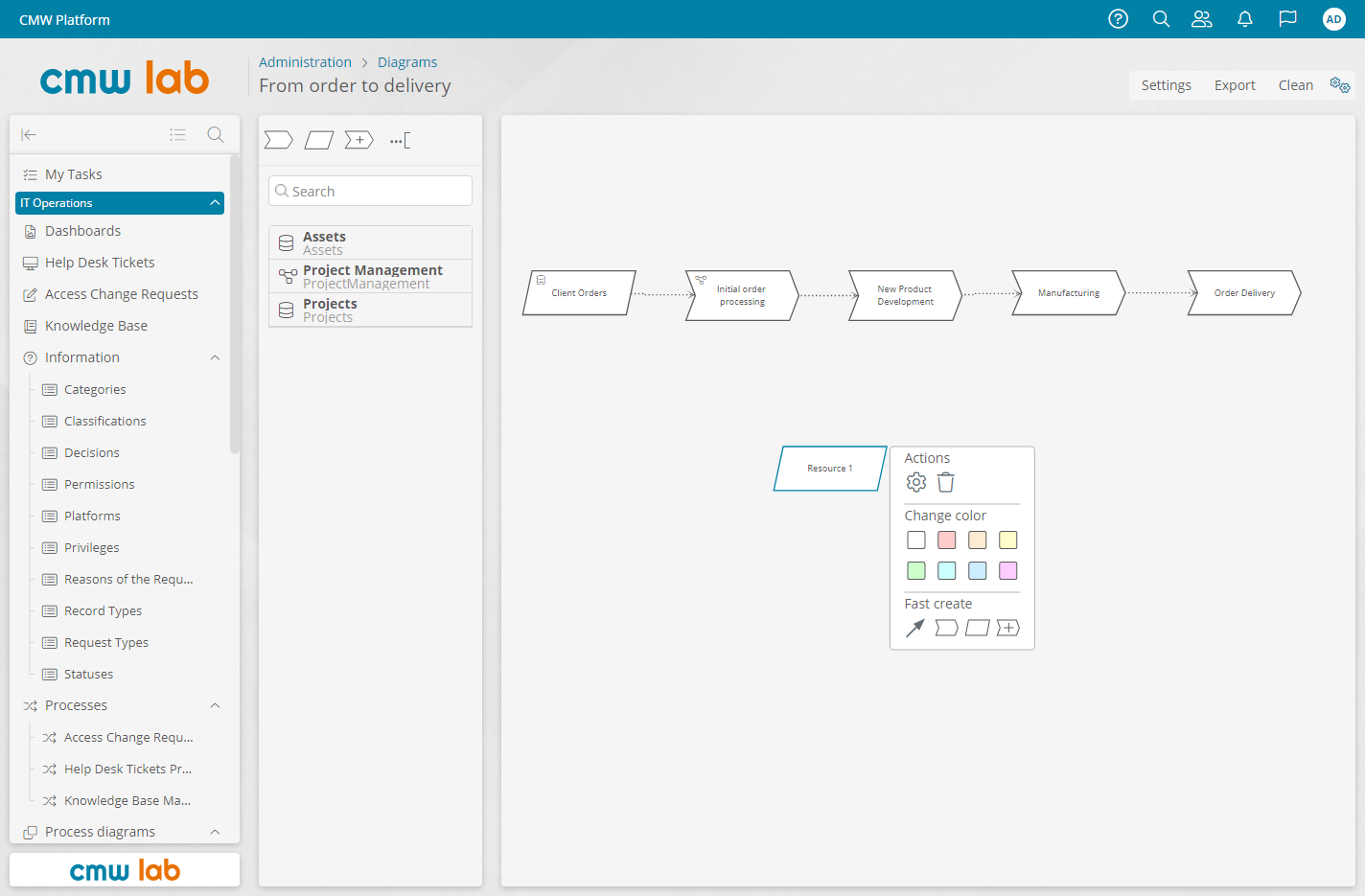

Design, roll out and visualize claims approval processes quickly via user-friendly graphical builder

Customize the system with all the details for claims processing you need. Link the necessary data to get fast and efficient claims handling:

Automation in claims processing is one of the key services insurance and healthcare companies provide. Common challenges are:

Leading companies use insurance claims handling software and healthcare claims management software to ensure the following benefits:

Your company has specific claim processing workflows that make you different from competitors — you are not alone. Process automation software by CMW Lab delivers necessary flexibility and makes it easy to adapt to your specific challenges and goals.

CMW Lab flexibility is outstanding. It can adapt to custom requirements and processes, and enables us to automate and manage our work more efficiently. And that is exactly what we were expecting from workflow software.»

CMW Trial

Any problems with form? Contact us.

Claims leakage is a term used in the insurance industry to describe the loss of funds or revenue resulting from inefficiencies, errors, or fraudulent activities in the claims handling and settlement process. In other words, claims leakage refers to the money that is lost or not recovered by insurers due to errors during the claims process.

Claims leakage can occur at different stages of the claims process, including claims reporting, investigation, settlement, and recovery. Examples of claims leakage include overpayment of claims, underpayment of claims, unnecessary expenses, duplicate payments, and fraudulent claims.

Recent reports show that switching to managing claims virtually reduces the processing time 5 times: from 10-15 days, to 2-3. Collecting all the necessary information about the claims can be managed through web forms, keeping paperwork and phone calls to a minimum. Substitute the slow and subjective human-based estimation process with consistent results provided to you via claims automation system.

Here are some examples of other verticals where claims process automation can bring significant results:

Related Topics: